Teacher: Gabriel TURINICI

Content

- classical portfolio mangement under historical probability measure: optimal portfolio, arbitrage, APT, beta

- Financial derivatives valuation and risk neutral probability measure

- Volatility trading

- Portfolio insurance: stop-loss, options, CPPI, Constant-Mix

- Hidden or exotic options: EFT, shorts

- Deep learning and portfolio strategies

Documents

NOTA BENE: All documents are copyrighted, cannot be copied, printed or ditributed in any way without prior WRITTEN consent from the author

| Chapter name | Theoretical part | Implémentation | Results |

|---|

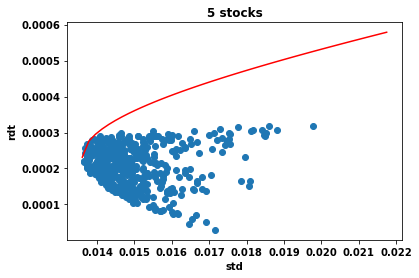

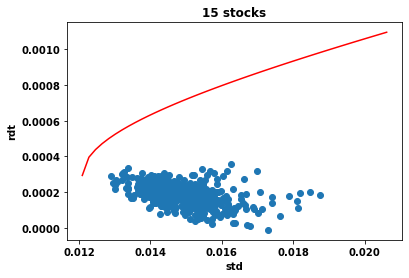

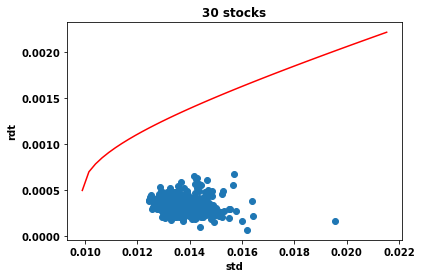

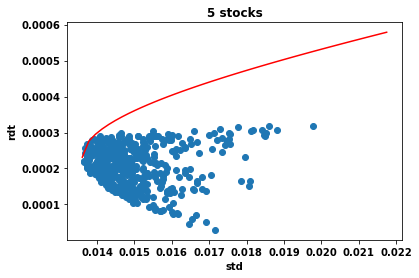

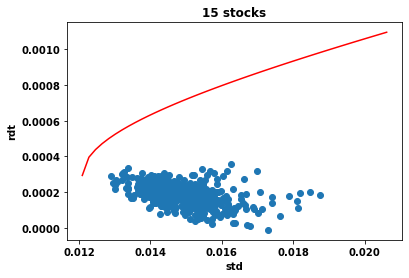

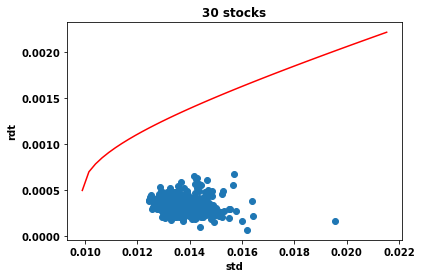

Classical portfolio management

(historical measure) |  slides slides | Python data: CSV format and PICKLE

Other data : shorter CSV (30/40)

Program: statistical normality tests to fill in

Program: optimal portfolio w/r to random portfolio, backtest to fill in

Full program: here |

|

| Financial derivatives and risk neutral probability |  BOOK M1 « Mouvement BOOK M1 « Mouvement

Brownien et évaluation d’actifs dérivés »

slides: reminders for financial derivatives | Code: Brownian and log-normal scenario generation,

Euler-Maruyama version to correct + MC computation ;

Monte Carlo option price

Codes: price & delta of vanilla call and put options, (log-normal = Black-Scholes) model

Delta hedging : initial code (notebook or python), final version (notebook or python) Bachelier model version |  |

| | | |

| | | |

| | | |

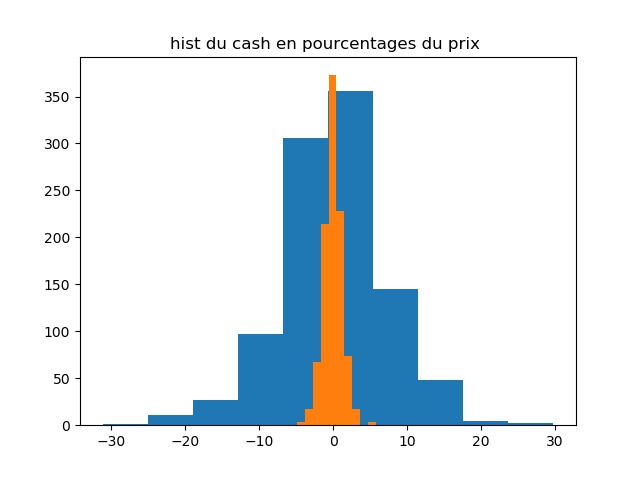

| Volatility trading | pdf document | Code: vol trading (another version here) | Results |

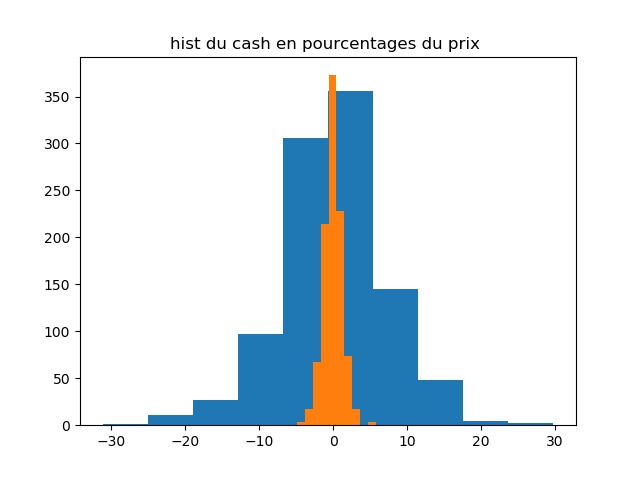

Portfolio insurance:

stop-loss, options,

CPPIs, Constant Mix | slides,

lsections 6.2 of M1 course textbook lsections 6.2 of M1 course textbook

Written notes

Youtube CPPI video:

part 1/2, part 1/2,  part 2/2 part 2/2

Beta slippage: presentation. | Code: stop loss, CPPI, CPPI v2

Constant-Mix

dataC40 | Result stop-loss, CPPI,

constant-mix |

| Deep learning for option pricing: basic price interpolation, advanced deep hedging | | Simple price interpolation code to fill in:

— python notebook

or

— pure python(rename *.txt to *.py)

Corrected code : python notebook

Advanced deep hedging : see article https://arxiv.org/abs/2505.22836 | |

| Tools | code

exemple: download Yahoo! Finance data | | |

| | | |

| Misc: | Projet (old version) | | |

Historical note: 2019/21 course name: « Approches déterministes et stochastiques pour la valuation d’options » + .